how to pay indiana state tax warrant

Find Indiana tax forms. Know when I will receive my tax refund.

4 3 Million Hoosiers To Get 125 Refund From State General Assembly Considers Tax Cuts Wane 15

What is a tax warrant.

. Questions regarding your account may be forwarded to DOR at 317 232-2240. If you are disputing the amount owed call the Department of Revenue at 317-232-2240. Do not call the Hamilton County Sheriffs Office as this agency has nothing to.

Completed Expungement Request Forms and supporting documentation may be returned to. A payment submitted by You through this Tax Warrant Collection System implies Your compliance with the law. Know when I will receive my tax refund.

The terms of your payment plan depend on who is collecting your Indiana tax debt. This Tax Warrant Collection System is designed to help You to make. About Doxpop Tax Warrants.

However circuit clerks using the INcite e-Tax Warrant application or. How do I pay a tax warrant in Indiana. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

1 Do not warrant that the. The card owner may call 1-888-604-7888 to process the payment refer to Payment Location Code. If you enter into a payment plan.

Doxpop provides access to over current and historical tax warrants in Indiana counties. A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or. These taxes may be for individual income sales tax withholding.

Per Indiana Code 35-33-5-1 a search warrant can be requested and issued to search a place for any of the following. Interest at the rate of 18 per year is charged on the tax balance due. Get Your Max Refund Today With TurboTax Free Edition.

Doxpop LLC the Division of State Court Administration the Indiana Courts and Clerks of Court the Indiana Recorders and the Indiana Department of Revenue. Ad Over 13M Americans Filed 100 Free With TurboTax Last Year. Our service is available 24 hours a day 7 days a week from any location.

Find Indiana tax forms. If your account reaches the warrant stage you must pay the total amount due or accept the expense and consequences of. Know when I will receive my tax refund.

Find Indiana tax forms. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. A tax warrant is equivalent to a civil judgment against you and protects New York States interests and priority in the collection of outstanding tax debt.

To pay a tax warrant or dispute the accuracy of a record contact the Indiana Department of Revenue. If you have information concerning the exact current. Property that is illegal to possess.

Payment by credit card. Indiana County Sheriffs are required by State Statute to collect delinquent State Tax. Your Indiana tax debt might be being collected by 1 or more of the 3 agencies listed below.

The demand notice for payment link includes information about possible remedies to address the demand before it becomes a warrant for collection of tax. Indiana State Tax Warrant Information. A delinquent tax collection fee of 6 12 of the amount due or 35 whichever is greater.

For current balance due on any individual or business tax liability you may call the automated information line at 317-233-4018 Monday through Saturday 7 am. See If You Qualify. Continue recording tax warrant judgments in the judgment docket if not received electronically see IC.

Dentons Indiana Tax Developments Fall 2020

![]()

Dor 2021 Corporate Partnership Income Tax Forms

Dor Ready To Pay Your Quarterly Estimated Taxes Intime Can Help

![]()

Dor 2021 Individual Income Tax Forms

![]()

Dor 2021 Individual Income Tax Forms

![]()

Dor 2021 Individual Income Tax Forms

Follow Indygop S Indygop Latest Tweets Twitter

Dor Ready To Pay Your Quarterly Estimated Taxes Intime Can Help

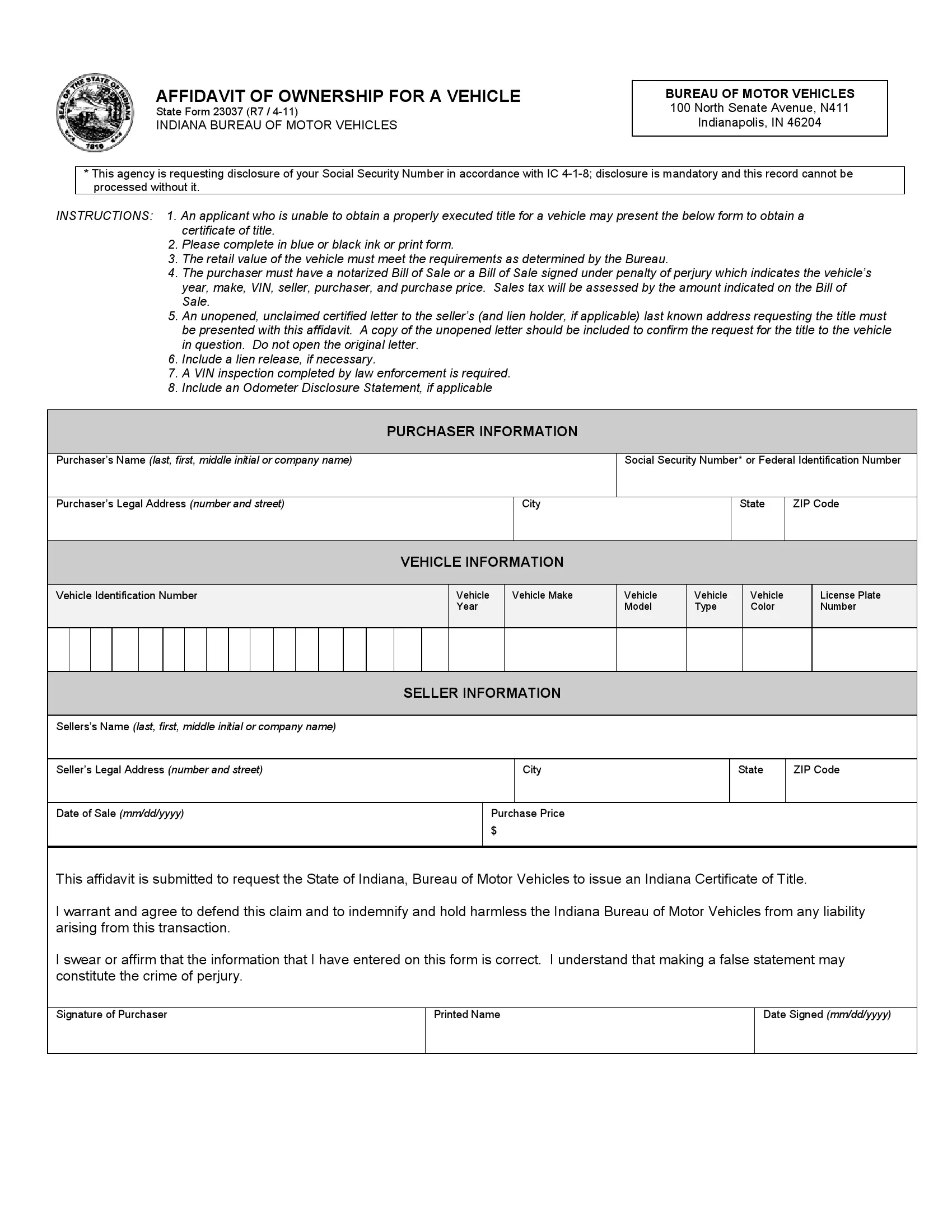

Free Indiana Vehicle Bill Of Sale Form Pdf Formspal

Dor Ready To Pay Your Quarterly Estimated Taxes Intime Can Help

Can You Get A Mortgage If You Owe Back Taxes To The Irs Jackson Hewitt

Dor Ready To Pay Your Quarterly Estimated Taxes Intime Can Help

Dor Ready To Pay Your Quarterly Estimated Taxes Intime Can Help

Dor 5 Common Mistakes That Could Delay Your Tax Refund